The Vital Distinction Between Invest In Gold and Google

페이지 정보

작성자 Sonya 작성일 24-12-14 16:42 조회 5 댓글 0본문

No matter which methodology you select, it’s essential to grasp how each investment sort works and what suits greatest along with your wants and threat tolerance. Silver’s worth tends to stay stable as a result of it’s used both as an investment and in numerous industries, like electronics and photo voltaic vitality. Well, it’s not like anyone else (a minimum of that I read) was posting this, both. Generally, decrease curiosity rates make holding non-interest-bearing property like gold and silver extra engaging, potentially boosting their prices. While it's true that the total accessible supply of gold retains rising(although slightly slowly as was mentioned earlier) the very fact stays that gold, like oil, is a non-renewable natural useful resource. As an example, silver finds substantial utilization in industries attributable to its unique properties, whereas gold is usually thought of a reserve asset. Both silver and gold have held substantial historical significance as investment assets resulting from their intrinsic value and stability.

No matter which methodology you select, it’s essential to grasp how each investment sort works and what suits greatest along with your wants and threat tolerance. Silver’s worth tends to stay stable as a result of it’s used both as an investment and in numerous industries, like electronics and photo voltaic vitality. Well, it’s not like anyone else (a minimum of that I read) was posting this, both. Generally, decrease curiosity rates make holding non-interest-bearing property like gold and silver extra engaging, potentially boosting their prices. While it's true that the total accessible supply of gold retains rising(although slightly slowly as was mentioned earlier) the very fact stays that gold, like oil, is a non-renewable natural useful resource. As an example, silver finds substantial utilization in industries attributable to its unique properties, whereas gold is usually thought of a reserve asset. Both silver and gold have held substantial historical significance as investment assets resulting from their intrinsic value and stability.

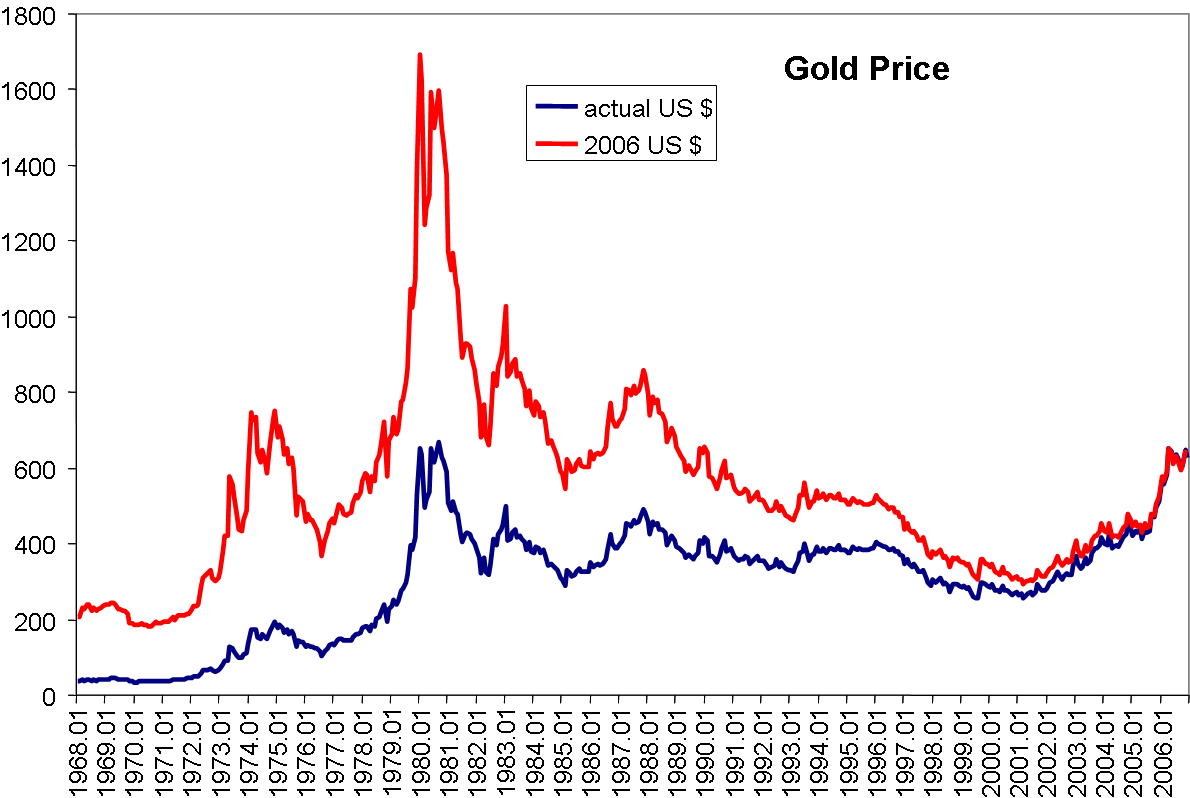

A comparative analysis of the historical efficiency of silver and gold as investment assets offers crucial insights into their conduct as safe-haven belongings. The challenge is to model dependency in each area and time seamlessly and simultaneously in order that the accuracy of evaluation will be improved (for example for regulation of multimodal transportation community) or the processing of aggregated info could be simplified (as an example for multimodal traveler info system). Diversification: Because gold is mostly not highly correlated to different belongings, it might help diversify portfolios, meaning the general portfolio is much less risky. However, if you’re looking for greater long-time period returns, investing in a diversified portfolio of stocks may be a better option. An ETF that holds physical bullion allows you to buy and promote it simply on the stock trade, getting the market value without needing to deal with a dealer who would possibly provide much less. Gold bars-extra commonly known as bullion-are a well-liked choice for people wanting to buy gold. Investing in gold and silver is a well-liked selection for individuals who want to protect their cash and guard in opposition to inflation.

A comparative analysis of the historical efficiency of silver and gold as investment assets offers crucial insights into their conduct as safe-haven belongings. The challenge is to model dependency in each area and time seamlessly and simultaneously in order that the accuracy of evaluation will be improved (for example for regulation of multimodal transportation community) or the processing of aggregated info could be simplified (as an example for multimodal traveler info system). Diversification: Because gold is mostly not highly correlated to different belongings, it might help diversify portfolios, meaning the general portfolio is much less risky. However, if you’re looking for greater long-time period returns, investing in a diversified portfolio of stocks may be a better option. An ETF that holds physical bullion allows you to buy and promote it simply on the stock trade, getting the market value without needing to deal with a dealer who would possibly provide much less. Gold bars-extra commonly known as bullion-are a well-liked choice for people wanting to buy gold. Investing in gold and silver is a well-liked selection for individuals who want to protect their cash and guard in opposition to inflation.

The yellow metal rose about 25 p.c in 2010. The value of gold is predicted to contact $1750 or even more by the top of 2011 and analysts advise investing within the yellow steel to stabilize your funding portfolio. If investing in individual stocks feels too dangerous or سعر الذهب اليوم في كندا time-consuming, you'll be able to select an ETF that invests in several mining corporations, providing you with diversification and lowering danger. Both the monetary crises of 2000 and 2008 highlighted the importance of diversification across a number of asset classes. Moreover, current years have seen a surge in demand for silver as an funding asset attributable to its applications in emerging technologies reminiscent of photo voltaic panels and electric automobiles. Most of the people does not yet fully perceive this mathematical object that's Bitcoin, but the evolution of its adoption and understanding world wide might be a decisive factor for the worth of gold : if investors grasp its worth and superiority as a trusted asset vis-à-vis gold, then the well-known precious metallic may be in for a bad day. The worth of this silver-white metallic is famously risky, capable of swinging by thousands of dollars per ounce over the course of months. However, it doesn't matter what sort of gold investment is held, it's critically essential for investors to control the gold price.

But understand that, as with all investments, there are inherent risks involved in gold funding. While each index funds and trade-traded funds (ETFs) supply diversified exposure to a broad number of market indexes, their operational frameworks are designed to satisfy different investor necessities. ETFs that own mining stocks: Funds that spend money on a variety of mining companies. Mining Stocks: Shares in firms that mine gold or silver. Deciding whether to invest in gold or silver depends on your financial targets, danger tolerance, and the current financial climate. Stocks, significantly those of massive, stable firms, have historically supplied a lot increased returns than gold or silver. Historically, silver has exhibited more pronounced value fluctuations in response to financial crises, whereas gold has been perceived as a extra stable store of value. Gold is seen as a hedge against inflation and a retailer of worth by way of market ups and downs. For instance, if you buy bullion, you’ll must store it securely your self, which is likely to be much less convenient than owning it by an ETF. I have to at this point guard myself towards the inference that could be drawn from these remarks that I advocate legislative interference with regard to banking generally, but it is obvious that the operations of banks, inasmuch as they affect the forex of the country, as undoubtedly they do, are quite distinct from these of strange industrial undertakings.

If you loved this post and you would like to receive far more info relating to سعر الذهب اليوم في كندا kindly pay a visit to the web-page.

- 이전글 Mediation Techniques for Beginners

- 다음글 The Reason Why Patio Door Repair Near Me Is More Risky Than You Thought

댓글목록 0

등록된 댓글이 없습니다.