Capital Lease Vs. Operating Lease: What’s The Distinction?

페이지 정보

작성자 Rosalie 작성일 24-12-28 03:41 조회 2 댓글 0본문

These deductions can decrease taxable revenue, offering monetary benefits. For operating leases, payments are handled as deductible rental bills. Whereas this simplifies tax reporting, it doesn’t offer the identical depreciation benefits as capital leases. Buy the asset, usually at a favorable worth. Return the asset to the lessor. Some agreements additionally provide renewal phrases, offering flexibility. Operating leases usually contain returning the asset to the lessor. Get a safety deposit: You wish to get a security deposit from your lessee earlier than leasing your asset. It will serve as a assure or a collateral that your lessee will return your asset in good situation and pay the lease cost on time. You wish to set the amount of the security deposit based mostly on the value, the depreciation, and the demand of your asset.

There are some instances during which it might make sense for a lessee to renegotiate or otherwise restructure an present aircraft lease. Whether the parties concerned want to renegotiate the lease relies upon totally on their related and respective wants and whether or not there are points that require renegotiation. Given that associated get together leases are usually dealt with internally, there are not often any issues. This method assumes that an asset depreciates extra rapidly in its early years and slows down over time. It known as "double-declining balance" as a result of the straight line charge is doubled and utilized to the asset’s e book value. The units of manufacturing depreciation method is an approach to allocating the cost of an extended-term asset based mostly on precise usage or production levels. This method is especially suitable for property where the wear and tear are extra closely tied to the level of productiveness quite than the passage of time. For instance, an organization that capitalizes an industrial machine can unfold the fee over its useful life, decreasing its tax burden every year. 2. Interest Deductions: The curiosity component of capital lease funds is tax-deductible. If a company has a excessive marginal tax price, this deduction might be significantly useful.

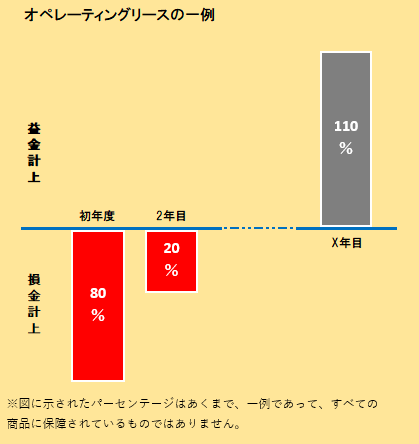

Leasing autos and equipment for enterprise use is a typical various to purchasing. The two kinds of leases—capital leases and operating leases—each have totally different effects on enterprise taxes and オペレーティングリース 節税スキーム accounting. Capital leases switch ownership to the lessee, while operating leases usually keep ownership with the lessor. Learn the main points of both leasing options so you can make smart leasing decisions. Capital leases switch possession to the lessee; operating leases often keep possession with the lessor. For accounting purposes, brief-term leases beneath 12 months in length are handled as bills and longer-term leases are capitalized as assets. 4. Ownership and Dangers: At the tip of a financial lease, the lessee typically gains possession, assuming the asset's dangers and rewards. Working leases conclude with the lessor retaining ownership, along with the related dangers. 5. Renewal and buy Options: Financial leases might embody a bargain purchase option, allowing the lessee to buy the asset at a price below market value.

It is important to notice that the expense recognition sample does differ for operating and finance leases. What is the Journal Entry for Operating Lease? Like we’ve mentioned above, ASC 842 is a sport-changer for lease accounting for U.S. With the brand new lease commonplace, operating lease preliminary journal entries will file a lease legal responsibility and proper-of-use (ROU) asset onto the balance sheet. Ongoing working lease journal entries will document a lease expense as common, as well as reducing the lease legal responsibility and ROU asset steadiness over the lease term. €398,778 to €797,555: 29.75% on the inheritance worth. And at last, above €797,555: 34% on the inheritance value. Keep in mind, that’s not the ultimate amount you’ll end up paying. There are a number of allowances that may doubtless apply to you, and they're going to cut back that amount. How can you keep away from inheritance tax?

댓글목록 0

등록된 댓글이 없습니다.